As a girl who works in finance, I get so many questions on how I make my budget, how I am able to save so much money, and how I stay on top of my finances. Today, I am sharing all of my tips for budgeting as well as sharing a free budget template!

1. Start with how much you will save

If we jump straight into expenses, there will be nothing left to save at the end of the month. A general rule of thumb is that you should be saving 20% of your monthly income. When you get your paycheck, immediately put your money into savings that way you cannot touch it. I put my savings in my company’s stock (that I get at a discount), my 401k (a must if your company offers it; allows you to save pre-tax dollars which allows you to lower the monthly income you get taxed on thus lower taxes), Roth IRA (an account that allows you to put after-tax dollars in and take the money out without tax at retirement), high-yield savings account (I use CIT bank), and CDs (Capital One has a high rate right now).

2. Plan out your essential expenses

Essential expenses include rent, groceries, insurance (everything that is essential to your daily living). This category should be about 50% of your monthly income. Your rent should be no more than 30% of your pre-tax income. I see so many people overpaying on rent which causes them to have nothing leftover in savings. This category can also be used to pay down debt (if you have any). Paying down your debt should be a priority!

3. Allocate the rest of your budget to having fun and treating yourself!

When people hear the word “budget,” they think that it means they cannot do fun things and cannot shop, get their nails done, etc. This is not true as long as you are responsible. If you are saving 20% of your money, covering all of your essential expenses, then you can use the rest to travel, get a facial, buy the shoes you have been wanting, etc. It is all about being responsible and transparent with yourself.

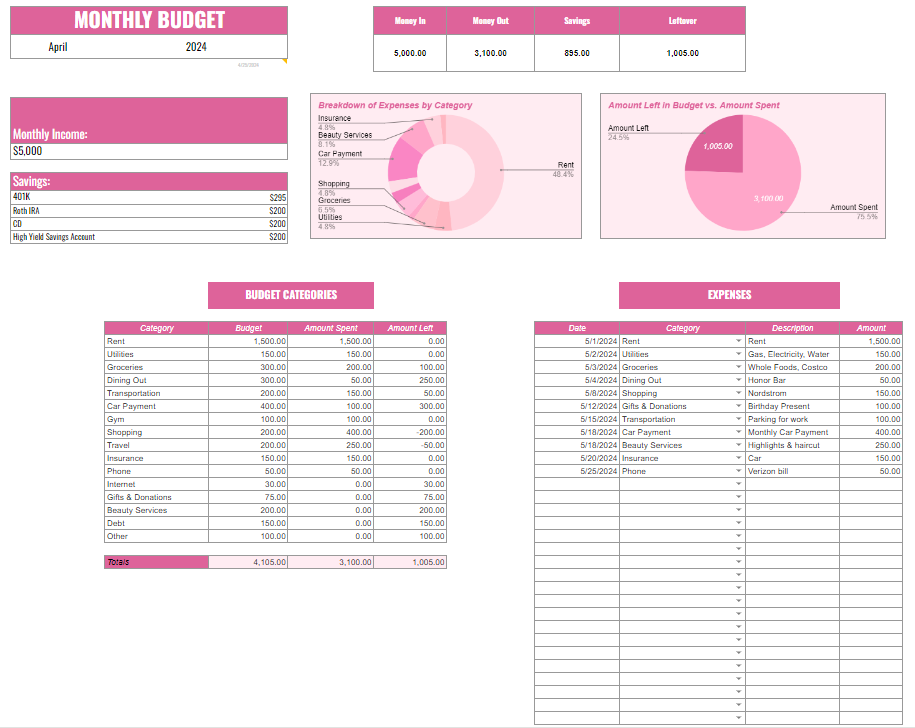

Free Budget Template (how to use + link)!

ACCESS THE FREE BUDGET TEMPLATE HERE!

Now that you know the basics of budgeting, it is time to put your new knowledge to use. It is SO important to track your budget on a spreadsheet. You must plan out the numbers and ensure that you are keeping track with how much you are spending and savings each month.

How to use the budget template:

- Start by inputting in the month and year

- Input your monthly income

- List out your savings underneath your monthly income

- Start listing out your essential expenses under “budget template”

- Then list out the rest of your expenses

- When you make a transaction, list it under “expenses”

- Track your money in, money out, and savings

- Put any leftover money into your savings

- See the breakdown of your expenses and where you are spending the most. Can you decrease your spending in a certain area?

- Create a new tab for each month of the year

If you have any questions, feel free to DM me on Instagram @thestyledsoutherner.

I hope this helps you stay on top of your finances and save!

Cheers

-Casey